The Gulf Cooperation Council region stands at the forefront of a global government digital transformation movement that is fundamentally reshaping how citizens interact with public services. All GCC countries now boast advanced telecom networks with 5G coverage exceeding 90 percent, high-speed internet and affordable connectivity, whilst significant investments in data centres and high-performance computing systems are driving AI readiness. For government IT leaders and web teams tasked with delivering exceptional citizen experiences whilst managing complex technology ecosystems, the strategic question is no longer whether to digitise services but rather how to balance mobile applications and web solutions to maximise accessibility, security and operational efficiency.

The data is compelling: 80 percent of residents prefer using mobile apps to access government services and information, whilst cities implementing mobile apps for citizen engagement experience a 72 percent increase in overall satisfaction among residents. Yet web platforms remain essential for complex transactions, comprehensive information provision and accessibility across diverse user segments. The most successful smart government initiatives in the Gulf region recognise that mobile apps and web solutions are not competing alternatives but complementary channels that together create seamless, omnichannel citizen experiences.

As the UAE continues to lead with its Digital Government Strategy 2025 built on eight dimensions including being digital by design, user-driven and proactive by default, and as Saudi Arabia accelerates Vision 2030 initiatives with over USD 20 billion in AI investments announced at LEAP 2025, government IT leaders across the GCC must navigate strategic decisions about technology architecture, citizen engagement platforms and digital service delivery models. This comprehensive guide provides the insights needed to design, implement and optimise smart mobile apps and web solutions that transform government service delivery whilst addressing the unique regulatory, cultural and infrastructure considerations of the Gulf region.

The Strategic Imperative: Why Gulf Governments Must Embrace Mobile-First Thinking

The shift towards mobile-first government services represents more than technological evolution—it reflects fundamental changes in citizen behaviour, expectations and interaction patterns that government entities cannot ignore.

Citizen Expectations Have Shifted Decisively Towards Mobile

Research indicates that 70 percent of citizens would prefer to interact with local governments through a mobile app rather than traditional methods, with some analyses placing the figure even higher at over 80 percent. This overwhelming majority reflects how everyday life has gone mobile—people spend approximately 87 percent of their mobile device time using apps rather than web browsers, naturally gravitating to apps for services including government interactions.

In the Gulf region where smartphone penetration exceeds 90 percent and mobile connectivity is ubiquitous, citizens who routinely use sophisticated mobile banking, shopping and communication apps expect comparable experiences from government services. The gap between private sector digital sophistication and government service delivery creates frustration and undermines citizen trust in digital government capabilities.

Mobile Delivers Measurable Service Improvements

Government agencies implementing mobile solutions achieve tangible performance improvements across multiple dimensions. Cities using apps for service requests achieve approximately 25 percent reduction in response times on average, with issues reported through apps (including photos and GPS location) routed instantly to the right department, eliminating paperwork and phone delays. Some communities report even larger gains—Boston’s 311 app led to 40 percent faster resolution of non-emergency issues in its first year.

Operational efficiency improvements are equally impressive. Mobile app adoption leads to 32 percent reduction in administrative costs through streamlined communication and reduced paperwork, whilst governments report 75 percent increase in staff efficiency for internal communication and task management. For 311 service requests specifically, 67 percent of citizen requests are now handled electronically through mobile apps, saving substantial time and resources.

Gulf National Strategies Mandate Digital-First Approaches

The UAE’s Digital Government Strategy 2025 explicitly emphasises being digital by design—ensuring digital aspects are embedded into overall government strategies from inception rather than added as afterthoughts. The strategy’s eight dimensions including user-driven, proactive and inclusive by default create clear mandates for mobile-accessible services that anticipate citizen needs.

Similarly, Saudi Arabia’s National Strategy for Data and Artificial Intelligence targets SAR 75 billion (approximately USD 20 billion) in AI investments by 2030, positioning the Kingdom among global leaders. These ambitious national strategies create predictable, government-backed demand for mobile and web solutions whilst signalling clear political commitment to digital transformation that IT leaders can leverage when building business cases for mobile initiatives.

Mobile Bridges the Digital Divide

Contrary to assumptions that mobile apps might exclude digitally underserved populations, mobile technology actually helps bridge access gaps. Mobile devices serve as primary internet access points for many residents who lack traditional computer access. Free government phone and service programmes connect underserved residents with essential government services including healthcare benefits and housing assistance, making mobile platforms critical for inclusive service delivery.

For comprehensive resources on building mobile-first government strategies aligned with Gulf national visions and citizen expectations, visit our resources section where we provide frameworks, templates and regional best practices.

Mobile Apps vs Web Solutions: A Strategic Comparison for Government Services

Government IT leaders must understand the strategic strengths, limitations and appropriate use cases for mobile applications versus web platforms. Rather than viewing these as either-or choices, successful digital government strategies leverage both channels strategically.

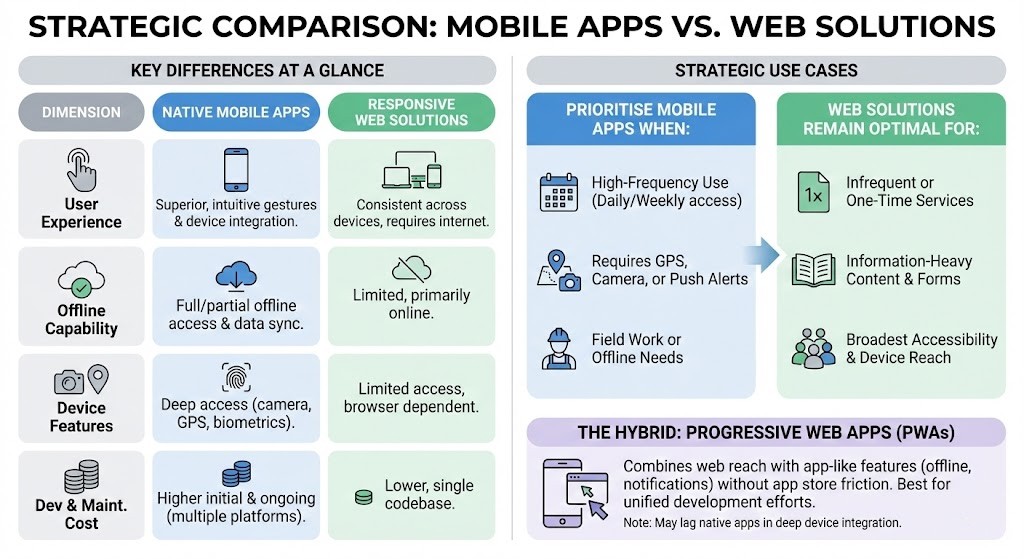

Comparative Analysis: Mobile Apps vs Responsive Web

| Dimension | Native Mobile Apps | Responsive Web Solutions |

|---|---|---|

| User Experience | Superior performance and intuitive gestures; platform-specific design patterns; seamless integration with device features | Good experience across devices; consistent interface; requires internet connectivity for most functions |

| Offline Capability | Full or partial offline functionality; data synchronisation when connected; critical for field operations | Limited offline capability; primarily requires active connection; progressive web apps offer some offline features |

| Device Integration | Deep integration with camera, GPS, biometrics, notifications and sensors; enables innovative service delivery | Limited access to device features; improving with modern browser APIs but still constrained |

| Development Complexity | Requires separate development for iOS and Android; higher initial development cost; specialised development skills | Single codebase serves all platforms; lower development cost; wider developer availability |

| Deployment & Updates | App store approval process; users must download updates; version fragmentation challenges | Instant deployment; users always access latest version; no approval process delays |

| Discovery & Acquisition | Requires users to find and download; app store visibility important; higher user commitment threshold | Instantly accessible via URL or search; lower barrier to initial access; SEO benefits |

| Security & Data | Enhanced security through device-level encryption; secure storage; biometric authentication | Secure but dependent on browser security; limited local storage; SSL/TLS for transmission |

| Cost to Maintain | Higher ongoing maintenance across platforms; separate bug fixes and updates for each platform | Lower maintenance burden; single codebase simplifies updates and fixes |

| Analytics & Tracking | Detailed usage analytics; user behaviour insights; push notification engagement metrics | Standard web analytics; behaviour tracking; limited to session-based insights |

| Best Use Cases | Frequent-use services; complex transactions requiring offline access; field operations; personalised experiences | Occasional-use services; information discovery; complex forms; services requiring large screens |

When to Prioritise Mobile App Development

Native mobile apps deliver greatest value for these government service scenarios:

High-Frequency Citizen Services – Services citizens access regularly (daily or weekly) justify the download friction. Examples include public transport tracking, parking payment, waste collection schedules and emergency services access. The convenience of immediate access without opening browsers drives adoption.

Services Requiring Device Integration – When services benefit from camera access for document scanning, GPS for location-based services, push notifications for real-time alerts or biometric authentication for secure identity verification, native apps provide superior capability.

Offline Functionality Requirements – Field inspectors, emergency responders and citizens in areas with intermittent connectivity require apps that function without constant internet access. Native apps can cache data, capture information offline and synchronise when connectivity resumes.

Personalised, Context-Aware Services – Apps excel at delivering personalised experiences based on user preferences, location, transaction history and behaviour patterns. Services that adapt to individual citizens’ needs benefit from app capabilities.

Complex Multi-Step Transactions – Processes requiring multiple stages, document uploads, interim saves and return-to-complete functionality work better in apps where state preservation is natural.

When Web Solutions Remain Optimal

Responsive web platforms are preferable for these scenarios:

Infrequent or One-Time Services – Services citizens use rarely (annually or less) don’t justify app downloads. Licence renewals, permit applications or occasional enquiries work well on responsive web platforms accessible via search.

Information-Heavy Services – Complex regulations, extensive documentation, detailed forms and comprehensive information repositories are better suited to web platforms where larger screens and traditional navigation patterns aid comprehension.

Universal Accessibility Requirements – When serving the broadest possible population including elderly citizens, those with limited digital literacy or users of diverse devices, web platforms reduce barriers by eliminating download requirements.

Services Requiring Large-Screen Interaction – Complex applications, detailed maps, extensive tables or processes benefiting from split-screen viewing work better on web platforms where screen real estate supports comprehensive displays.

Services in Early Adoption Phases – Launching new services via web platforms enables rapid iteration based on user feedback before committing to native app development investment.

The Hybrid Approach: Progressive Web Apps

Progressive Web Apps (PWAs) represent an emerging middle path that combines advantages of both approaches. PWAs are web applications that leverage modern browser capabilities to provide app-like experiences including offline functionality, push notifications and installation to home screens—all without app store distribution.

For government services, PWAs offer compelling advantages including single development effort serving all platforms, instant updates without user action, no app store approval delays and lower development costs compared to native apps. However, PWAs still lag native apps in device integration depth and may not support all features citizens expect from government service apps.

Essential Features for Gulf Government Mobile and Web Solutions

Successful government digital services in the Gulf region must incorporate specific capabilities that address citizen expectations, regulatory requirements and operational needs unique to the region.

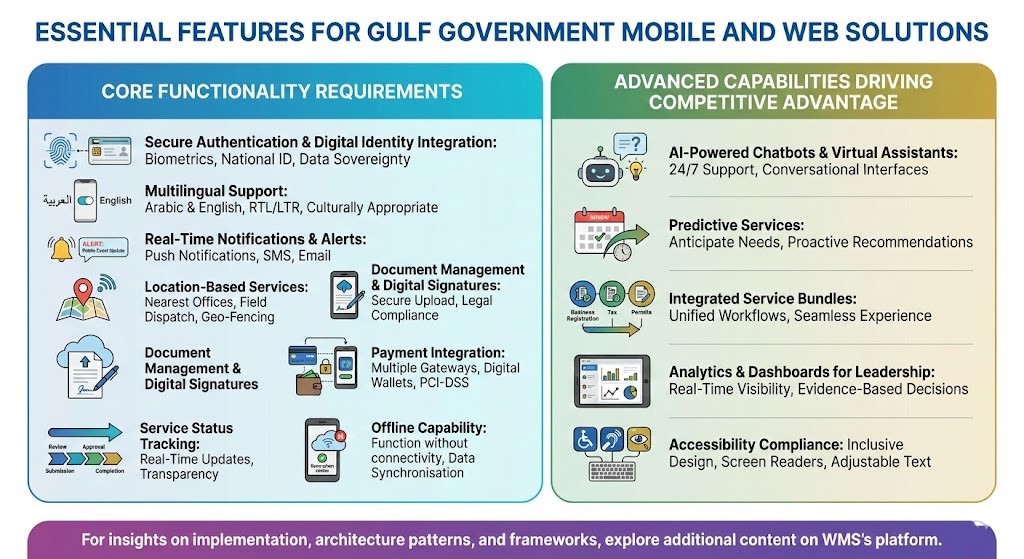

Core Functionality Requirements

Secure Authentication and Digital Identity Integration – Gulf governments are advancing digital identity initiatives including mobile driver’s licences and unified citizen identity platforms. Government apps and web services must integrate with national digital identity systems, supporting secure authentication via biometrics, national ID cards and digital credentials whilst meeting data sovereignty requirements.

Multilingual Support – All government services must function seamlessly in both Arabic and English, with right-to-left text handling, culturally appropriate content presentation and localised user experiences. Some GCC countries require additional language support for large expatriate communities.

Real-Time Notifications and Alerts – Research shows 84 percent of citizens desire real-time alerts and notifications from governments during emergencies, public events or service updates. Mobile apps must deliver timely push notifications whilst web platforms provide email and SMS alternatives for users who haven’t installed apps.

Location-Based Services – GPS integration enables services including finding nearest government offices, location-specific alerts, field service dispatch and spatially-aware information delivery. Privacy protections must ensure location data handling complies with regional regulations.

Document Management and Digital Signatures – Citizens must be able to upload identification documents, certificates and supporting materials securely. Services requiring signatures should support digital signature standards recognised by Gulf legal frameworks.

Payment Integration – Seamless integration with regional payment gateways, support for multiple payment methods including credit cards, debit cards, digital wallets and government payment platforms, and compliance with PCI-DSS and regional financial regulations.

Service Status Tracking – Transparency through real-time status updates for applications, requests and transactions. Citizens should track progress from submission through approval, mirroring private sector e-commerce tracking experiences.

Offline Capability – For mobile apps, critical services should function with limited or no connectivity, synchronising when connection resumes. This capability is essential for field operations and ensures service continuity.

Advanced Capabilities Driving Competitive Advantage

AI-Powered Chatbots and Virtual Assistants – Intelligent conversational interfaces answering common questions, guiding citizens through processes and providing 24/7 support in multiple languages reduce service centre burden whilst improving citizen satisfaction.

Predictive Services – Proactive government means anticipating citizen needs. Intelligent systems that remind citizens of upcoming renewals, suggest relevant services based on life events and provide personalised recommendations transform reactive service delivery into proactive citizen care.

Integrated Service Bundles – Rather than requiring citizens to navigate multiple departments for related services, integrated platforms bundle connected services. For example, new business registration automatically initiates tax registration, licence applications and relevant permits through single unified workflows.

Analytics and Dashboards for Leadership – Government executives require real-time visibility into service delivery performance, citizen satisfaction metrics, transaction volumes and operational efficiency. Comprehensive dashboards transform raw data into actionable insights supporting evidence-based decision-making.

Accessibility Compliance – Inclusive design ensuring services are accessible to citizens with disabilities including screen reader compatibility, alternative text for images, keyboard navigation, adjustable text sizes and high-contrast modes. This isn’t merely best practice—it’s increasingly mandated by regional regulations.

For insights on how leading Gulf governments implement these features and resources including technical architecture patterns and feature prioritisation frameworks, explore additional content on WMS’s platform.

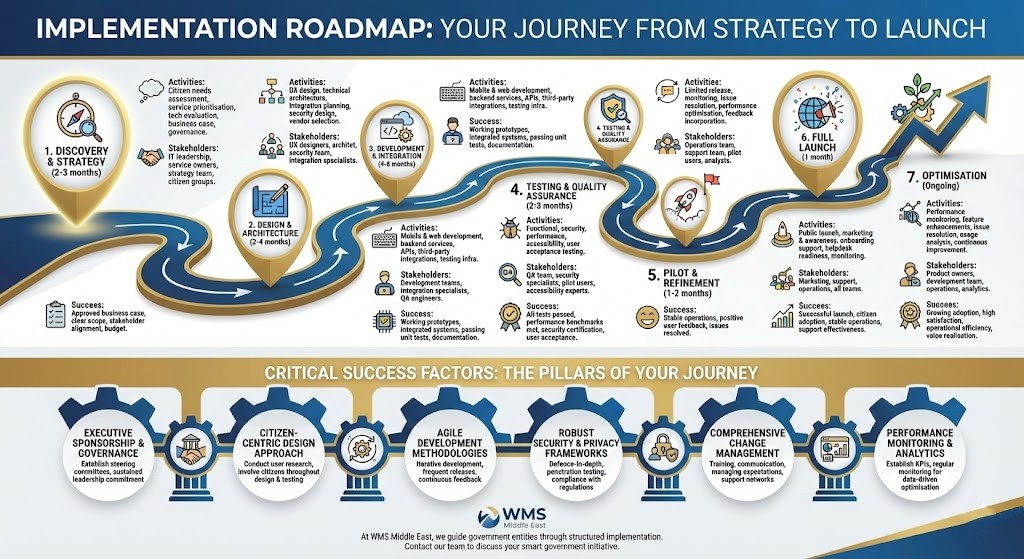

Implementation Roadmap: From Strategy to Launch

Successful government digital service implementation requires structured approaches that balance ambition with pragmatism, ensuring initiatives deliver value whilst managing complexity and risk.

Phase-Based Implementation Timeline

| Phase | Duration | Key Activities | Primary Stakeholders | Success Criteria |

|---|---|---|---|---|

| Phase 1: Discovery & Strategy | 2–3 months | Citizen needs assessment; service prioritisation; technology evaluation; business case development; governance establishment | IT leadership, service owners, strategy team, citizen focus groups | Approved business case; clear scope; stakeholder alignment; budget allocation |

| Phase 2: Design & Architecture | 2–4 months | User experience design; technical architecture; integration planning; security design; vendor selection if needed | UX designers, architects, security team, integration specialists | Approved designs; technical specifications; integration roadmap; security framework |

| Phase 3: Development & Integration | 4–8 months | Mobile and web development; backend services; API development; third-party integrations; testing infrastructure | Development teams, integration specialists, QA engineers | Working prototypes; integrated systems; passing unit tests; documentation complete |

| Phase 4: Testing & Quality Assurance | 2–3 months | Functional testing; security testing; performance testing; accessibility testing; user acceptance testing | QA team, security specialists, pilot users, accessibility experts | All test cases passed; performance benchmarks met; security certification; user acceptance |

| Phase 5: Pilot & Refinement | 1–2 months | Limited release; monitoring and analytics; issue resolution; performance optimisation; feedback incorporation | Operations team, support team, pilot users, analysts | Stable operations; positive user feedback; issues identified and resolved |

| Phase 6: Full Launch | 1 month | Public launch; marketing and awareness; onboarding support; helpdesk readiness; monitoring | Marketing, support, operations, all teams | Successful launch; citizen adoption; stable operations; support effectiveness |

| Phase 7: Optimisation | Ongoing | Performance monitoring; feature enhancements; issue resolution; usage analysis; continuous improvement | Product owners, development team, operations, analytics | Growing adoption; high satisfaction; operational efficiency; value realisation |

Critical Success Factors

Executive Sponsorship and Governance – Digital transformation requires sustained leadership commitment. Establish steering committees with representation from IT, service delivery departments, security, legal and citizen advocates. Executive sponsors provide political cover for difficult decisions and secure necessary resources.

Citizen-Centric Design Approach – Technology capabilities must serve citizen needs, not dictate service design. Conduct user research including surveys, interviews and usability testing with diverse citizen segments. Involve citizens throughout design and testing to ensure solutions address actual needs rather than assumed requirements.

Agile Development Methodologies – Traditional waterfall approaches with lengthy development cycles before release create risks of building solutions misaligned with citizen needs. Agile methodologies with iterative development, frequent releases and continuous feedback loops enable course corrections based on real-world usage.

Robust Security and Privacy Frameworks – Government services handle sensitive citizen data requiring exceptional security. Implement defence-in-depth security architectures, conduct regular penetration testing, ensure compliance with regional data protection regulations and maintain comprehensive audit trails. Security cannot be afterthought—it must be embedded throughout development.

Comprehensive Change Management – Technology implementation alone doesn’t transform service delivery—people and processes must change as well. Provide training for government staff, communicate changes to citizens, manage expectations and build support networks that sustain transformation beyond initial launch.

Performance Monitoring and Analytics – Establish key performance indicators from project inception covering citizen satisfaction, transaction completion rates, service delivery times, system performance, adoption metrics and operational costs. Regular monitoring enables data-driven optimisation and demonstrates return on investment to stakeholders.

At WMS Middle East, we guide government entities through structured implementation that balances ambition with pragmatism, ensuring digital transformation initiatives deliver measurable citizen value whilst building sustainable capabilities. Contact our team to discuss your smart government initiative and leverage our experience delivering successful mobile and web solutions across the Gulf region.

Security, Privacy and Compliance: Non-Negotiable Foundations

Government digital services must meet security and privacy standards that exceed private sector requirements given the sensitive nature of citizen data and the potential impacts of breaches on national security and public trust.

Regional Regulatory Framework

Data Sovereignty and Localisation – GCC countries maintain varying data protection and sovereignty requirements impacting where citizen data can be stored and processed. Strict data localisation requirements in Saudi Arabia and the UAE mandate sensitive data storage within national borders. Mobile and web architectures must accommodate these requirements through in-country data centres, data residency controls and compliant cross-border transfer mechanisms where permitted.

Personal Data Protection Laws – Saudi Arabia’s Personal Data Protection Law and similar regulations across GCC countries establish compliance requirements for collecting, processing and storing citizen data. Government services must implement privacy-by-design principles, obtain appropriate consent, provide transparency about data usage and enable citizen rights including data access and correction.

Cybersecurity Requirements – The UAE’s National Cybersecurity Strategy and Saudi Arabia’s Essential Cybersecurity Controls establish baseline security requirements for government systems. Mobile apps and web platforms must meet these standards covering secure authentication, encrypted communications, vulnerability management and incident response.

Security Architecture Best Practices

Multi-Factor Authentication – Single-factor authentication (username and password) provides inadequate security for government services. Implement multi-factor authentication combining something users know (password), something they have (mobile device, security token) and something they are (biometrics). Integration with national digital identity platforms provides strong authentication whilst improving user experience.

End-to-End Encryption – Data must be protected both in transit and at rest. Implement TLS/SSL for all communications, encrypt sensitive data in databases and secure backups. Mobile apps should leverage device-level encryption capabilities for locally stored data.

API Security – Mobile apps and web platforms rely on APIs to communicate with backend systems. Secure APIs through authentication (OAuth 2.0, API keys), authorisation controls limiting data access based on roles, rate limiting preventing abuse, input validation preventing injection attacks and comprehensive logging of API access.

Regular Security Testing – Conduct periodic vulnerability assessments, penetration testing and code reviews. Engage independent security firms for objective assessments. Address identified vulnerabilities promptly based on risk severity. Maintain vulnerability disclosure programmes enabling responsible disclosure by external researchers.

Incident Response Preparedness – Despite best efforts, security incidents may occur. Establish comprehensive incident response plans covering detection, containment, investigation, remediation and communication. Regular tabletop exercises ensure readiness when incidents occur.

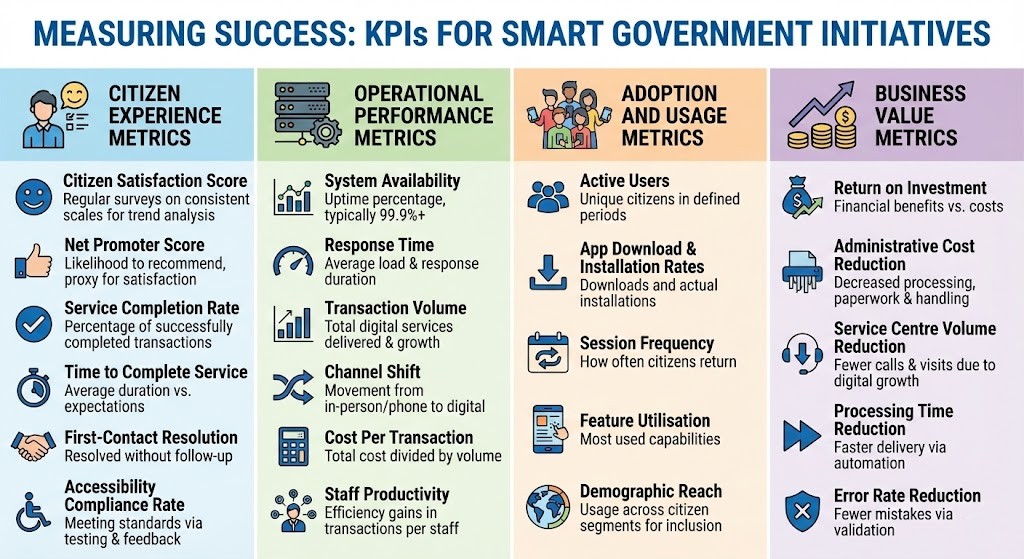

Measuring Success: KPIs for Smart Government Initiatives

Government IT leaders must demonstrate return on investment and citizen value through comprehensive performance measurement frameworks that balance quantitative metrics with qualitative citizen experience indicators.

Citizen Experience Metrics

- Citizen Satisfaction Score – Regular surveys measuring overall satisfaction with digital services on consistent scales enabling trend analysis

- Net Promoter Score – Likelihood citizens would recommend digital services to others, indicating strong proxy for satisfaction and service quality

- Service Completion Rate – Percentage of initiated transactions completed successfully without abandonment

- Time to Complete Service – Average duration from service initiation to completion, with targets reflecting citizen expectations

- First-Contact Resolution – Percentage of service requests resolved without requiring follow-up interactions

- Accessibility Compliance Rate – Percentage of services meeting accessibility standards measured through automated testing and user feedback

Operational Performance Metrics

- System Availability – Uptime percentage with targets typically 99.9 percent or higher for critical services

- Response Time – Average time for services to load and respond to citizen interactions

- Transaction Volume – Total services delivered through digital channels with growth trends

- Channel Shift – Percentage of services moving from in-person or phone to digital channels

- Cost Per Transaction – Total cost of delivering service divided by transaction volume

- Staff Productivity – Efficiency gains measured through transactions processed per staff member

Adoption and Usage Metrics

- Active Users – Number of unique citizens using services within defined periods (daily, monthly, annually)

- App Download and Installation Rates – For mobile apps, downloads and actual installations on devices

- Session Frequency – How often citizens return to use services

- Feature Utilisation – Which capabilities citizens use most, informing prioritisation

- Demographic Reach – Service usage across citizen segments ensuring inclusive access

Business Value Metrics

- Return on Investment – Financial benefits compared to implementation and operational costs

- Administrative Cost Reduction – Decreases in processing costs, paperwork and manual handling

- Service Centre Volume Reduction – Decreased phone calls and in-person visits as digital channels grow

- Processing Time Reduction – Faster service delivery through automation and streamlined workflows

- Error Rate Reduction – Fewer mistakes through automated validation and structured data entry

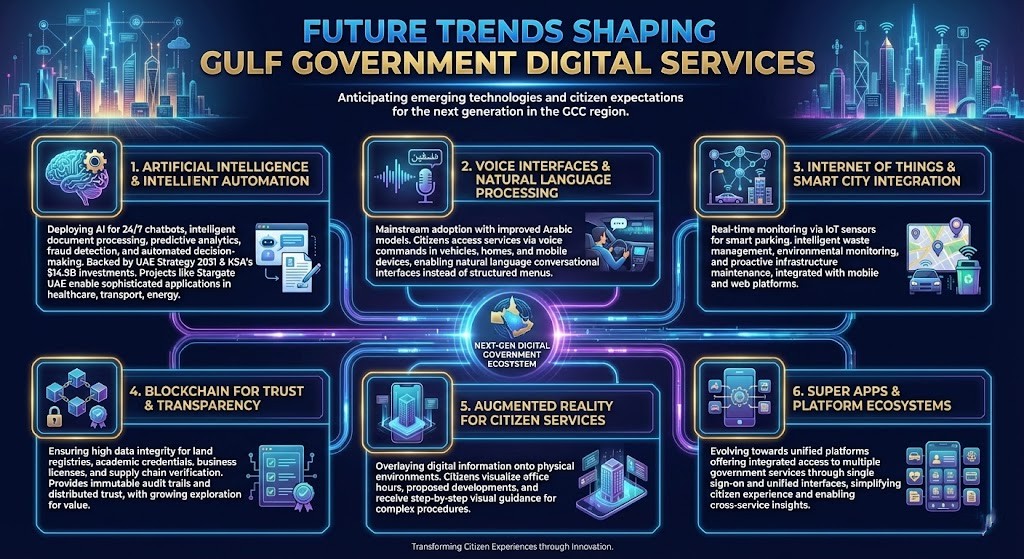

Future Trends Shaping Gulf Government Digital Services

Government IT leaders must anticipate emerging technologies and citizen expectations that will shape the next generation of digital government services in the GCC region.

Artificial Intelligence and Intelligent Automation

The UAE National Strategy for Artificial Intelligence 2031 emphasises deploying AI across government services, whilst Saudi Arabia’s LEAP 2025 saw USD 14.9 billion in new AI investments announced. Government applications include AI-powered chatbots providing 24/7 citizen support, intelligent document processing extracting data from forms and documents, predictive analytics anticipating service demand and resource requirements, fraud detection identifying anomalous patterns in transactions and automated decision-making for routine approvals meeting defined criteria.

As projects like Stargate UAE’s 200-megawatt AI compute cluster become operational in 2026, computational capabilities will enable increasingly sophisticated AI applications transforming government service delivery across healthcare, transportation, energy and beyond.

Voice Interfaces and Natural Language Processing

Voice-activated services will become mainstream as natural language processing improves and Arabic language models mature. Citizens will access services through voice commands in vehicles, homes and mobile devices. Government services must adapt to conversational interfaces where citizens describe needs in natural language rather than navigating structured menus.

Internet of Things and Smart City Integration

The proliferation of IoT sensors throughout Gulf cities enables real-time monitoring and responsive services. Smart parking directing drivers to available spaces, intelligent waste management optimising collection routes, environmental monitoring providing air quality alerts and smart infrastructure detecting maintenance needs before failures create new possibilities for proactive government services integrated with mobile and web platforms.

Blockchain for Trust and Transparency

Blockchain technology offers compelling capabilities for government applications requiring high assurance of data integrity including land registries, academic credentials, business licences and permits and supply chain verification. Whilst adoption remains early stage, exploration is growing particularly for use cases where immutable audit trails and distributed trust provide value.

Augmented Reality for Citizen Services

AR applications will overlay digital information onto physical environments. Citizens could point phones at government buildings to see office hours and services, visualise proposed development projects in actual locations or receive step-by-step visual guidance for complex procedures. As AR capabilities mature, innovative government services will leverage these capabilities.

Super Apps and Platform Ecosystems

Following successful super app models in Asia where single applications provide diverse services, Gulf governments may evolve towards unified platform approaches. Rather than separate apps for each department, comprehensive platforms providing integrated access to multiple services through single sign-on and unified interfaces will simplify citizen experience whilst enabling cross-service insights.

Conclusion: Building the Foundation for Next-Generation Government

The Virtual Assistant Readiness Assessment

For government IT leaders and web teams across the Gulf Cooperation Council, the imperative is clear: citizen expectations, national digital strategies and competitive dynamics make sophisticated mobile apps and web solutions essential rather than optional. The GCC region’s advanced telecommunications infrastructure with 5G coverage exceeding 90 percent, significant investments in AI and data centre capabilities, and ambitious national visions create unprecedented opportunities to deliver world-class government digital services.

Success requires more than technology deployment—it demands strategic thinking about channel selection, citizen-centric design approaches, robust security and privacy frameworks, and commitment to continuous improvement based on citizen feedback and usage analytics. The choice between mobile apps and web solutions isn’t binary—the most effective strategies leverage both channels appropriately based on service characteristics, citizen preferences and operational requirements.

The implementation journey from strategy through launch and optimisation is complex, involving coordination across departments, vendors and stakeholders whilst managing technical complexity, security requirements and citizen expectations. Organisations that approach digital transformation with structured methodologies, appropriate governance, and sustained executive commitment achieve measurable improvements in citizen satisfaction, operational efficiency and cost effectiveness that justify investments many times over.

As artificial intelligence, IoT integration, blockchain and augmented reality mature, the capabilities available to government digital services will continue expanding dramatically. Forward-thinking government entities that establish strong digital foundations today through well-designed mobile apps and web platforms position themselves to rapidly adopt these emerging capabilities, maintaining leadership in citizen service delivery.

The data demonstrates compelling value: 72 percent increase in citizen satisfaction, 25 percent reduction in response times, 32 percent reduction in administrative costs and 75 percent increase in staff efficiency among governments implementing mobile and web solutions. These aren’t aspirational goals—they’re documented achievements from governments that have embraced digital transformation strategically.

Ready to transform your government entity's digital capabilities and position your organisation as a leader in citizen service delivery? The team at WMS Middle East brings extensive experience implementing mobile apps and web solutions for government entities across the Gulf region. We understand the unique regulatory requirements, cultural considerations and technical constraints that impact government digital transformation in the GCC.

Don’t let outdated service delivery models continue limiting your organisation’s ability to meet citizen expectations and national digital strategy requirements. Take the first step toward comprehensive smart government capabilities that improve citizen satisfaction, enhance operational efficiency and demonstrate effective stewardship of public resources. Your citizens expect digital services matching private sector sophistication—ensure you’re positioned to deliver exceptional experiences across all channels.

The era of smart government has arrived in the Gulf region. Ensure your entity is leading rather than following in this critical transformation.

Frequently Asked Questions (FAQs)

Does this require replacing our current BI tools?

No. Virtual assistant complements BI (doesn’t replace). You’ll likely keep dashboards for monitoring/standardized reporting, and add assistant for ad-hoc/self-service queries. They’re different tools for different needs.

How accurate is Arabic language understanding?

For business queries in Modern Standard Arabic (MSA) or Gulf dialect: 85-90% accuracy after initial training[1]. Improves over time as it learns your terminology. Start with 80% accurate, improve to 90%+ by month 3.

Can it access data from non-SAP systems (Salesforce, Oracle, etc.)?

Yes. SAP BTP integrates with non-SAP systems via APIs. Initial setup focuses on SAP S/4HANA (your core system), then expands to others based on user need.

What if someone asks a question it can’t answer?

Assistant says “I don’t know” or “I don’t have access to that data.” Users can submit feedback; admin adds capability. Graceful failure is key—not guessing wrong answers.

Is our data secure? Can anyone ask anything?

Security is same as your BI tools. Row-level and field-level security enforced. Users see only data they’re authorized to see. All queries logged for audit. Salary data? Only HR can see. Customer payment terms? Only credit team can see.

Can it work offline (for field workers)?

Limited offline capability. Can cache recent queries/results. But real-time data queries require connection. For field workers: Mobile data or WiFi needed for live queries.

How long does implementation take?

Pilot: 30 days (connect to SAP, build 30-50 questions). Full rollout: 90 days (enterprise-wide, 100+ questions, all personas).

What’s ongoing maintenance?

Minimal. Admin reviews failed questions monthly, adds new capabilities quarterly. SAP BTP is cloud-managed (no infrastructure maintenance). Budget: $20-40K annually.

Can it integrate with WhatsApp or Teams?

Yes. Virtual assistant can be deployed as: Mobile app, web chat, Teams bot, Slack bot, WhatsApp Business. Users choose preferred interface.

What if our data is messy/inconsistent?

Clean critical data first (customer master, product master, financials). 80% clean is good enough to start. Assistant helps identify data quality issues as you go.

Can business users create new questions or is it IT-only?

Depends on complexity. Simple questions: Business users can train assistant (with guidance). Complex integrations: IT/admin required. Goal: Empower business over time.

What’s typical ROI and payback period?

Analyst time savings alone: Typical 6-12 month payback[2]. Add better decisions, faster time-to-insight: ROI often 200-500% in year one. Some organizations see 2-3 month payback if heavy report generation culture.

Mahitab Maher

SAP professional specializing in SAP products, helping companies turn complex processes into smooth, scalable operations.

References & Data Sources

[1] Arabic NLP accuracy (Modern Standard Arabic + Gulf dialect models, Spark NLP and SAP CAI support) – Based on SIGARAB mission for Arabic NLP support

[2] Virtual Assistant ROI data – Based on Middle East bank case (150K+ daily conversations with 99%+ STP), retail case (22% stockout reduction), and conversational analytics case studies showing 40% data analysis time reduction

Sources Referenced:

- Conversational AI Analytics trends: “Conversational AI Analytics for Enterprises (2025)” – Ampcome, 2025[web:124]

- SAP Conversational AI capabilities: “How to Build a Digital Assistant with SAP Conversational AI” – Mastering SAP, 2022[web:125] and SAP Community documentation[web:128]

- NLP in Business Intelligence: Binary Semantics, 2025[web:126] and Coherent Solutions, 2024[web:132]

- Self-Service BI adoption: Research Nester and Straits Research data cited in BitEchnology article, 2025[web:141]

- Self-Service BI benefits: SR Analytics guide, 2025[web:144]

- Arabic NLP challenges: John Snow Labs, 2024[web:139]; SpotIntelligence, 2023[web:142]; Verloop.io, 2025[web:145]

- GCC AI trends: Esfera Soft, 2025[web:140]; Appinventiv, 2025[web:149]; TJDEED, 2025[web:143]

- Middle East bank case: Kore.ai customer story, 2025[web:146]

- JPMorgan Chase NLP implementation: Coherent Solutions, 2024[web:132]

- Data-driven company statistics: McKinsey research cited in SR Analytics, 2025[web:144]

The explanation of enterprise challenges was very realistic. It reflects what many organizations are currently facing.

Appreciate your comment, James. Addressing real-world challenges is important to us, and we’re pleased you found the discussion relevant.

Very relevant content for businesses in the GCC region. The practical examples make it easier to understand the impact.

Thank you, Omar. We aim to provide regionally relevant insights that support real business challenges. We appreciate you taking the time to share your thoughts.

The practical examples included in this article make it easier to understand the value of SAP solutions.

Thank you, Practical context helps organizations better understand how to maximize the value of SAP investments.

I appreciate how the article connects strategy with measurable business outcomes. That’s often missing in technical discussions.

Thanks, Sophia. Aligning strategy with measurable results is essential for successful SAP implementations. We’re glad this resonated with you.

I appreciate how this article focuses on practical business impact rather than just technical features.

Thanks, Michael. Business outcomes are always at the core of successful SAP implementations. We appreciate your feedback.

This article provides strong insights into how enterprises can improve operational efficiency. Very relevant for organizations investing in digital transformation.

Thank you, Daniel. We’re pleased you found the insights valuable. Supporting organizations in their digital transformation journey is at the core of what we do.

A very relevant discussion for government entities in the Gulf. Digital public services are becoming essential for efficiency and citizen engagement.

Thank you, Ahmed. Digital transformation in public services is indeed a key priority across the Gulf region. We appreciate your valuable perspective.